does california have an estate tax in 2020

A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS. In the state of California there is no estate tax.

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Thats not true in every state.

. An estate is all the property a person owns money car house etc. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. You must have an annual income of less than 35500 and at least 40 equity in your home.

Income Tax on Trusts that. Uncategorized does california have an estate tax in 2020. The government takes estate taxes before any of.

Townhomes for rent in mt juliet tn Facebook. Therefore a California Estate Tax Return is not required to. The 2020 Form 541 may be used for a taxable year beginning in 2021 if both of the following apply.

There really is no tax that would be chargeable to you as a beneficiary for receiving an inheritance. Effective January 1 2005 the state. The exemption is 117 million for 2021 Even then youre only taxed for the portion that exceeds the exemption.

In the Tax Cuts and Jobs Act of 2017 the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31 2025. New Jersey finished phasing out its estate tax at the same time and now only imposes an inheritance tax. Homeowners age 62 or older can postpone payment of property taxes.

When a person passes away their estate may be taxed. Some states have a state-level inheritance tax requiring that you have to pay a tax on what you receive as an inheritance. Even though California wont ding you with the death tax there are still estate taxes at the federal level to consider.

The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. A trust is an agreement to hold and. The tax rate on gifts in excess of 11580000 remains at 40.

In California we do not have a state level inheritance tax. The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state death tax credit over a four 4 year period beginning January 2002. The delayed property taxes must eventually be paid payment is secured by a lien against the property.

The estate tax exemption reduced by certain lifetime gifts also increased to 11580000 in 2020 until after 2025. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million. Estate taxes though are different than inheritance taxes.

California along with 37 other states dont impose an estate tax no matter how big the estate is. However after January 1 2005 the IRS no longer allows the state death tax credit. Estate and inheritance taxes are burdensome.

Thats not the case in California. The federal estate tax goes into effect for estates valued at 1206 million and up in 2022 for singles. Administrator of the estate executor Person who may receive property or income from the estate beneficiary Property.

Estates generally have the following basic elements.

California Had Its Driest February On Record Here S How Bad It Was The New York Times

Small Business Start Up Kit For California The

California State Tax Refund Ca State Income Tax Brackets

12727 Highwood St Los Angeles Ca 90049 Trulia House Exterior Luxury Homes Mansions

California Estate Tax Everything You Need To Know Smartasset

Prop 19 And How It Impacts Inherited Property For California Residents Financial Alternatives

Everything About California Capital Gains Tax

Is Inheritance Taxable In California California Trust Estate Probate Litigation

California Estate Tax Everything You Need To Know Smartasset

California Estate Tax Everything You Need To Know Smartasset

Moving From California To Colorado Benefits Cost How To

California S White Homeowners Get Bigger Prop 13 Tax Breaks Calmatters

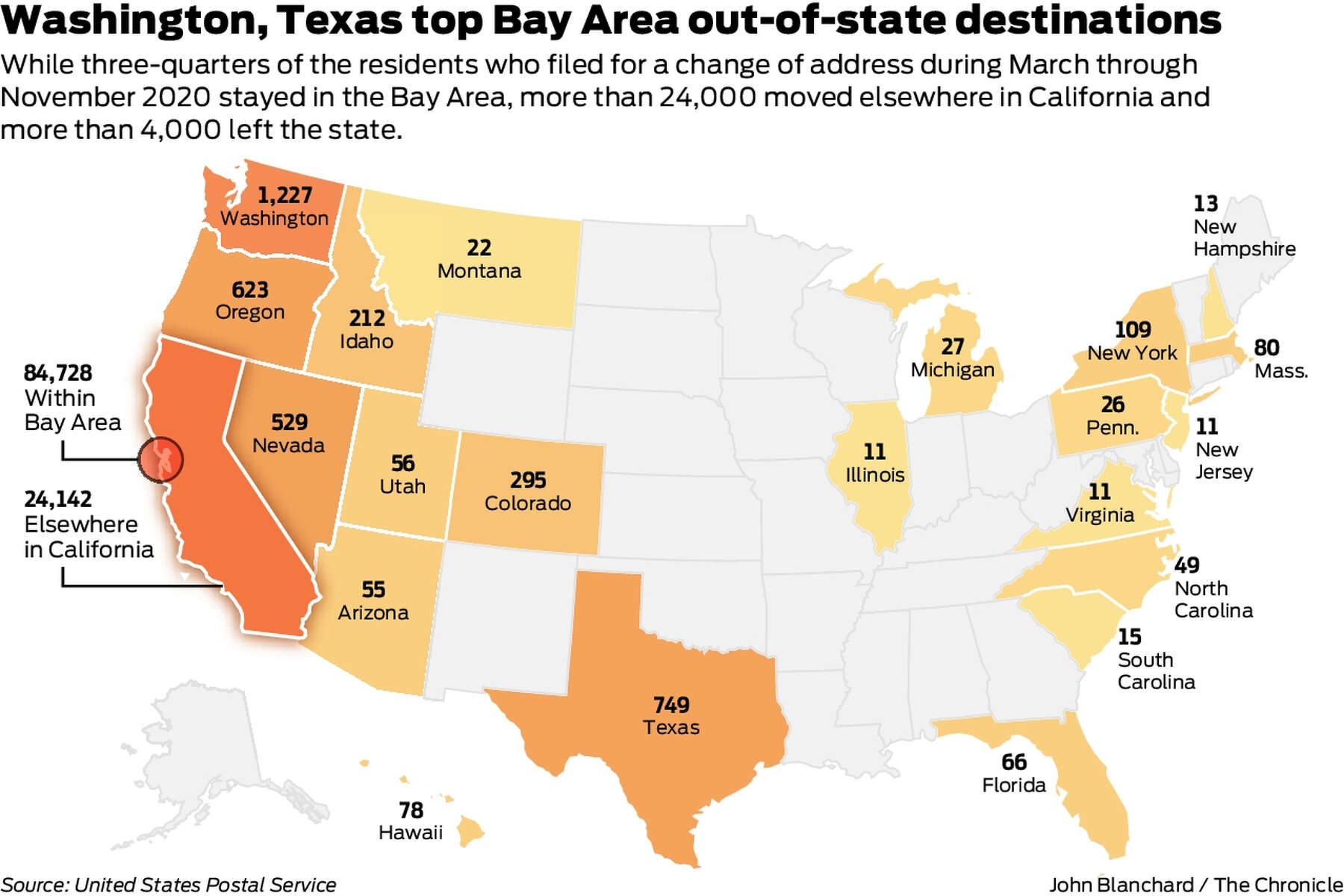

Bay Area S Migration Is Real But Postal Service Data Shows California Exodus Isn T

Estate Planning Victor Pantaleoni Estate Planning Business Entrepreneur Estate Tax

2020 Jackson St San Francisco Ca 94109 7 Beds 7 5 Baths Mansions Pacific Heights Townhouse

California Proposes Tax Increases Again With Wealth Tax